Our News

Our News

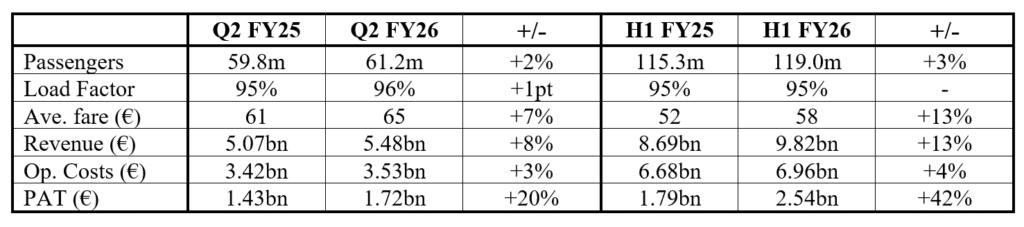

RYANAIR REPORTS Q2 PROFIT UP 20% TO €1.72BN H1 UP 42% TO €2.54BN DUE TO STRONG EASTER, Q2 FARE RECOVERY & SLOWER GROWTH

Ryanair Holdings plc today (3 Nov.) reported Q2 PAT of €1.72bn, up 20% on PY Q2 PAT of €1.43bn. H1 PAT rose 42% to €2.54bn, as traffic grew 3% to 119m passengers while fares rose 13% due to a strong Easter, weak prior-year comps and Q2 fare recovery.

H1 highlights include:

• Traffic grew 3% to a record 119m.

• Rev. per pax up 9% (ave. fare +13% & ancil. rev. +3%).

• Strong cost control as unit costs rise just 1%.

• 199 B737 “Gamechangers” in 636 fleet at 30 Sept.

• 2 new bases & 91 new routes (over 2,500) on sale for S.26.

• Jet fuel hedges extended: 80% of FY27 at just under $67bbl.

• Ryanair added to MSCI Global & FTSE Russell indices.

• €0.193 interim div. per share declared (payable in Feb. 2026).

H1 REVIEW

Ryanair Group CEO Michael O’Leary, said:

Revenue & Costs:

“H1 revenues rose 13% to €9.82bn. Scheduled revenue increased 16% to €6.91bn as traffic grew 3% but fares rose 13%. Fares benefitted from having the full Easter holiday in Q1 (with weak prior-year comps) and we achieved a full recovery of the 7% fare decline we suffered in last years Q2. Ancillary revenue was solid, rising 6% to €2.91bn. Operating costs rose 4% (+1% per pax) to €6.96bn as our fuel hedges helped offset higher ATC fees (up 14%) and enviro. costs (ETS allowance unwind and SAF blend mandates from last Jan.).

H2 FY26 fuel is c.85% hedged at $76bbl (de-risking the Group for the remainder of this year) and we’ve taken advantage of recent price dips to extend our FY27 hedge cover to 80% at just under $67bbl, locking in price savings of over 10% in our fuel costs next year.

Balance Sheet, Liquidity & Returns:

Ryanair’s balance sheet is strong with a BBB+ credit rating (both Fitch and S&P) and unencumbered B737 fleet (610 aircraft). At 30 Sept., gross cash was €3bn after €1.2bn debt repayments (incl. our €850m bond in Sept.), €1.1bn capex and €0.4bn shareholder distributions. Liquidity is further boosted by the Group’s RCF which has c.€1bn undrawn. Net cash rose to over €1.5bn from €1.3bn at 31 Mar., leaving the Group well positioned to fund capex and repay our last remaining bond (€1.2bn) in May 2026 from internal cash resources. This financial strength widens the cost gap between Ryanair and our competitors, many of whom remain exposed to expensive (long-term) finance and rising aircraft lease costs.

In May, we launched a €750m share buyback. At 30 Sept. we had purchased (and cancelled) over 7m shares (approx. 25% of programme) at a cost of €188m. Today, the Board (in line with Ryanair’s dividend policy) declared an interim dividend of €0.193 per share (payable in late Feb. 2026).

FLEET & GROWTH

Boeing’s improved deliveries continued through S.25 and into Oct., enabling our Group to carry extra passengers in H1 and selectively add capacity over the peak Oct. mid-term school holidays and into the Christmas/New-Year peak travel period. Ryanair had 204 B737-8200 “Gamechangers” in its 641 fleet at the end of Oct. and we’re confident that the last 6 remaining Gamechangers (210 orderbook) will deliver well ahead of S.26, facilitating 4% traffic growth to 215m next year (FY27). Boeing expects MAX-10 certification in mid 2026 and they expect to meet our contract delivery dates for our first 15 MAX-10s in Spring 2027, with 300 of these fuel-efficient aircraft due to deliver by Mar. 2034. As part of our preparations for the MAX-10s, we need to accelerate cadet and first officer (“FO”) recruitment for the next 3 years. While this investment in training and growth (approx. €25m p.a.) will increase FO crewing ratios for up to 3 years, it will provide a strong pool of home-grown FOs ready for promotion to Captains when MAX-10 deliveries ramp-up in FY29/FY30. We’ve also taken advantage of recent US$ weakness and hedged approx. 35% of our MAX-10 firm order (150 aircraft) capex at an average €/$ rate of 1.24, locking-in further capex savings on these low-cost aircraft.

This winter, we’ve allocated Ryanair’s scarce capacity to those regions and airports cutting aviation taxes and incentivising traffic growth such as Sweden, Slovakia, Italy, Albania and Morocco by switching flights and routes away from high cost, uncompetitive markets like Germany, Austria and regional Spain. This trend will continue into S.26, with over 2,500 routes now on sale (incl. new bases in Tirana and Trapani and 91 additional routes).

We expect European short-haul capacity to remain constrained to at least 2030 as the big 2 OEMs remain behind on aircraft production, Pratt & Whitney engine repairs continue to be an issue for many Airbus operators, EU airline consolidation accelerates (incl. Air Europa, SAS & TAP) and unprofitable airlines withdraw capacity from markets where they are unable to compete with Ryanair’s lower costs. Industry capacity constraints, combined with our widening cost advantage, strong balance sheet, low-cost aircraft orderbook and industry leading ops resilience will, we believe, facilitate Ryanair’s controlled profitable growth to 300m passengers p.a. by FY34.

ESG

During H1 we took delivery of 23 new Gamechangers (4% more seats, 16% less fuel & CO2) and benefitted from the retrofit of winglets to approx. 60% of our B737NG fleet (1.5% lower fuel burn and 6% less noise). Our 409 NGs will be retrofitted by the end of 2026 and we expect to have all 210 Gamechangers in our fleet well ahead of S.26. We recently agreed to purchase 30 CFM LEAP-1B spare engines (a $500m commitment) to improve our operational resilience. Over 50% of these engines were delivered at 30 Sept., with the balance expected in coming months. These latest technology engines reduce fuel consumption and CO2 emissions per seat by up to 20%. The Groups significant investment in new technology, coupled with ambitious SAF commitments, positions Ryanair as one of Europe’s most environmentally efficient airlines.

As expected, following the lifting of the prohibition on non-EU nationals purchasing Ryanair’s ord. shares in Mar. (while continuing to apply voting restrictions) and Ryanair’s inclusion in the MSCI Global and FTSE Russell indices, we’ve seen increased global investor interest. At 30 Sept. the proportion of Ryanair’s issued share capital held by EU nationals was 33% (significantly above the 20% threshold for potential re-introduction of purchase restrictions), while 100% of voting rights remained in the hands of EU investors.

EUROPE IS FAILING ON COMPETITIVENESS

We remain concerned that Ursula von der Leyen (and her new Commission) have done nothing, over the past 14 months, to improve European competitiveness by implementing the Sept. 2024 Draghi Report recommendations. Europe’s airlines have called for a level playing field on enviro. taxes, by bringing ETS rates into line with CORSIA, and urgent ATC reform by protecting overflights during national strikes, and ensuring that Europe’s major ATC providers in France, Germany, and Spain are fully staffed for the first wave of daily departures. These reforms are urgent and it’s about time President von der Leyen stopped talking about reform and started to deliver it.

While the Commission stands idly by, the EU Parliament is proposing even more stupid rules (such as further increasing free carry-on luggage limits – even though there is no room in the aircraft cabin for these extra bags) which will only lead to more airport security and flight delays as well as higher costs, and higher fares for Europe’s consumers.

OUTLOOK

FY26 traffic is now expected to grow by more than 3% to 207m passengers (previously 206m), due to earlier than expected Boeing deliveries and strong H1 demand. Unit costs performed well in H1 and, as previously guided, we expect only modest FY26 unit cost inflation as our B-8200 deliveries, fuel hedging and effective cost control across the Group helps offset increased ATC charges, higher enviro. costs and the roll-off of last years modest delivery delay compensation. While Q3 forward bookings are slightly ahead of PY, particularly across the Oct. mid-term and Christmas peaks, we would caution that we face more challenging PY fare comps in H2 making fare growth more challenging. Q3s fare outcome will be determined by close-in Christmas and New Year bookings. As is normal at this time of year, we have zero Q4 visibility and there is no Easter benefit in this year’s Q4.

It remains too early to provide meaningful FY26 PAT guidance. We do, however, cautiously expect to recover all of last years 7% full-year fare decline, which should lead to reasonable net profit growth in FY26. The final FY26 outcome remains exposed to adverse external developments, incl. conflict escalation in Ukraine and the Mid. East, macro-economic shocks and any further impact of repeated European ATC strikes & mismanagement.”

Related News

RYANAIR LAUNCHES PRAGUE – PAPHOS & KOSICE ROUTES

Ryanair, Europe’s No.1 airline, today (1st August) celebrated the first flight from Prague to Paphos, while on Monday (3rd August) it will launch a twice weekly service to Kosice, both as part of its extended Summer 2020 schedule.

To celebrate its new routes, Ryanair has launched a seat sale with fares from 729 Kc for travel to Kosice and from 759 Kc to Paphos, both until the end of October, which must be booked by Wednesday (5th August), only on the Ryanair.com website.

RYANAIR LAUNCHES PRAGUE – PAPHOS & KOSICE ROUTES

Ryanair, Europe’s No.1 airline, today (1st August) celebrated the first flight from Prague to Paphos, while on Monday (3rd August) it will launch a twice weekly service to Kosice, both as part of its extended Summer 2020 schedule.

To celebrate its new routes, Ryanair has launched a seat sale with fares from 729 Kc for travel to Kosice and from 759 Kc to Paphos, both until the end of October, which must be booked by Wednesday (5th August), only on the Ryanair.com website.